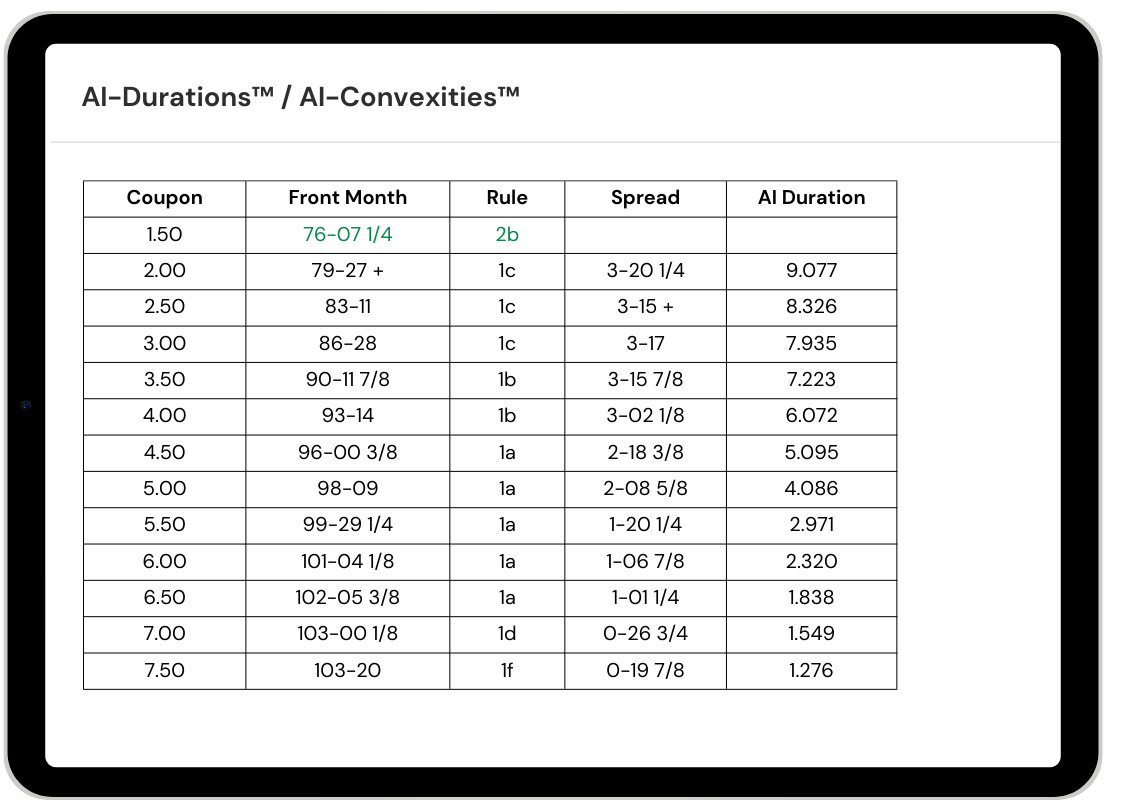

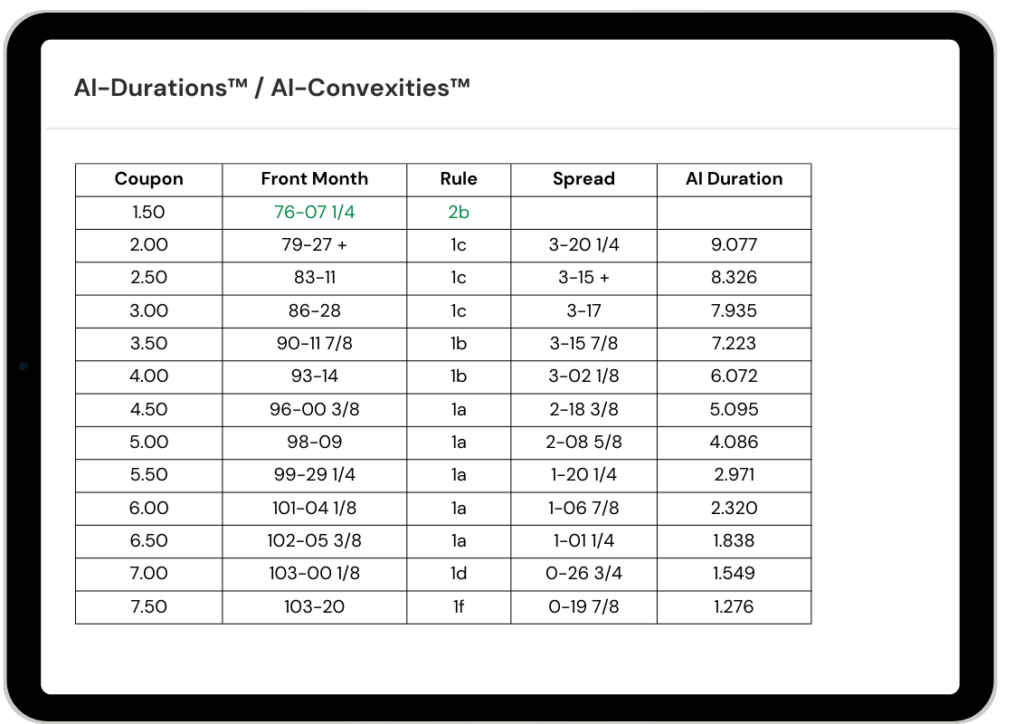

AI-Durations™

AI-Convexities™

Transparent TBA Analytics

A simplified and transparent methodology used to derive TBA Durations and Convexities, utilized by the CME for InterCommodity Spreads (ICS).

TBA Futures – CME Group

Measuring TBA Price Sensitivities

MIAC TBA Fixings™ used to derive AI-Durations/AI-Convexities

MIAC’s AI-Durations and AI-Convexities are derived from MIAC TBA Fixings. The actual market price fixing of each adjacent TBA Coupon is used to derive the Implied price sensitivity of each TBA Coupon. However, because of the underlying price volatility and variability embedded in the TBA market, a time series of implied price sensitivities is used to derive the average implied (AI) Durations and Convexities.